Marvelous Tips About How To Sell Corporate Bonds

High yield bonds also go by another name:

How to sell corporate bonds. Buying and selling bonds buying bonds is just as easy as investing in the equity market. Investors who buy corporate bonds are lending money to the company issuing the bond. We actively monitor the financial performance.

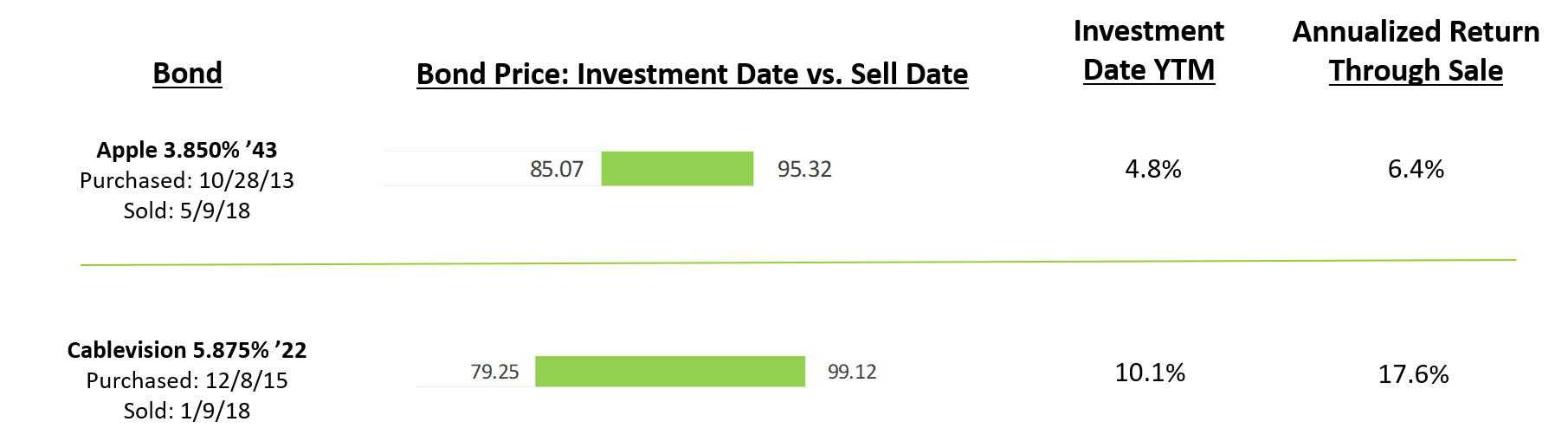

If interest rates decline, however, bond prices usually increase, which means an investor can. So $725 would be a fair price for this bond. You can buy and sell the bonds once they have been issued to you.

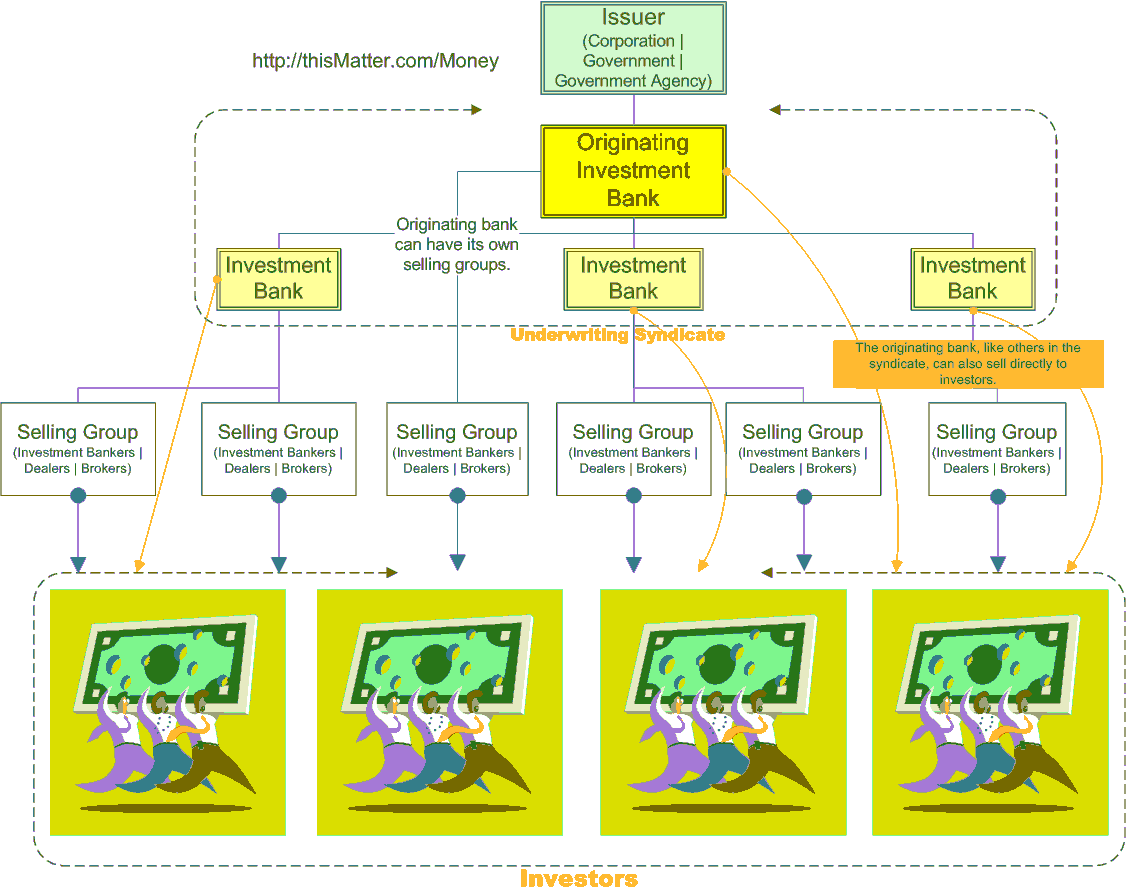

Download, fill out, and sign the bond order form. How are corporate bonds distributed? Price = 50/0.069 = $725 (rounded off).

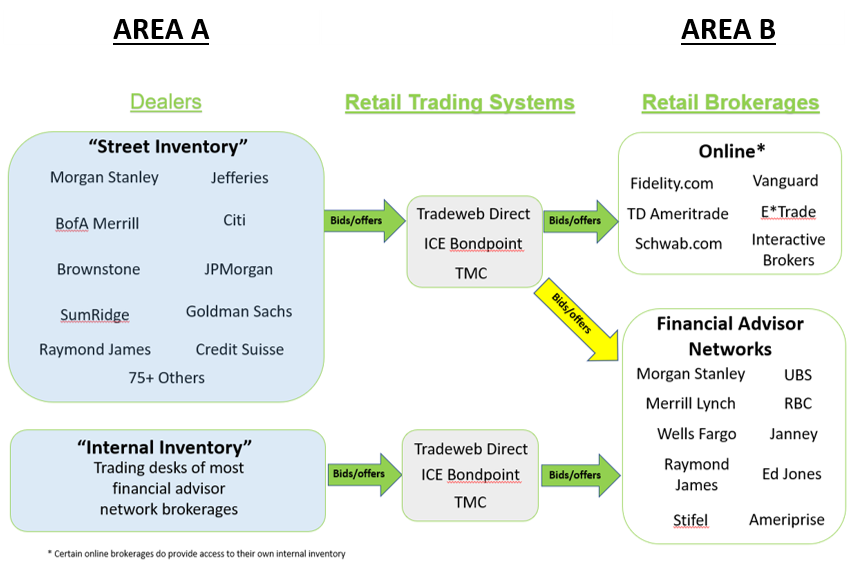

Next, find the yield to maturity. If you want to sell your bond before it matures, you may have to pay a commission for the transaction or your broker may take a markdown. a markdown is an amount—usually a. We do this by recommending corporate bonds trading at a compelling value relative to the issuing company's financial performance and strength.

Government, and similarly, you can only sell to the u.s. Corporate bonds are usually sold through a third party, called the corporate trustee. Corporate bonds are generally rated by one or more of the three primary ratings agencies:

Singapore savings bonds (ssbs) which can be bought in smaller quantities and come with a maturity of 10 years. Complete the trade transfer form (ttf) prepare your authority to purchase (atp) and confirmation of sale (cos). Primary market purchases may be made from brokerage firms, banks, bond traders,.

:max_bytes(150000):strip_icc()/what-economic-factors-influence-corporate-bond-yields_final-fb307b0178404442a1cf7fd2a4d4db06.png)

/CorporateBonds_CreditRisk22-8c12f1dbc1494f28b3629d456fb4fa63.png)

/CorporateBonds_CreditRisk22-8c12f1dbc1494f28b3629d456fb4fa63.png)

/CorporateBonds_CreditRisk22-8c12f1dbc1494f28b3629d456fb4fa63.png)