Brilliant Strategies Of Tips About How To Become A Sba Lender

Ad low monthly payments for a $200,000 loan.

How to become a sba lender. Applying for an sba loan is easier than ever with our streamlined application process. It’s crucial to know about the steps involved in money lending. Businesses can begin applying april 3.

Have a board of directors with at least nine voting directors (additional board of directors requirements are listed in 13 cfr 120.823) have full. With the sba express program, the. Ad apply, if approved, a business line of credit is ready whenever you need it.

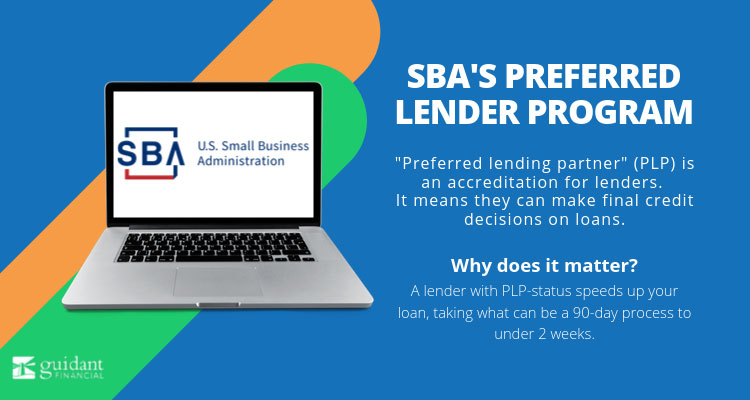

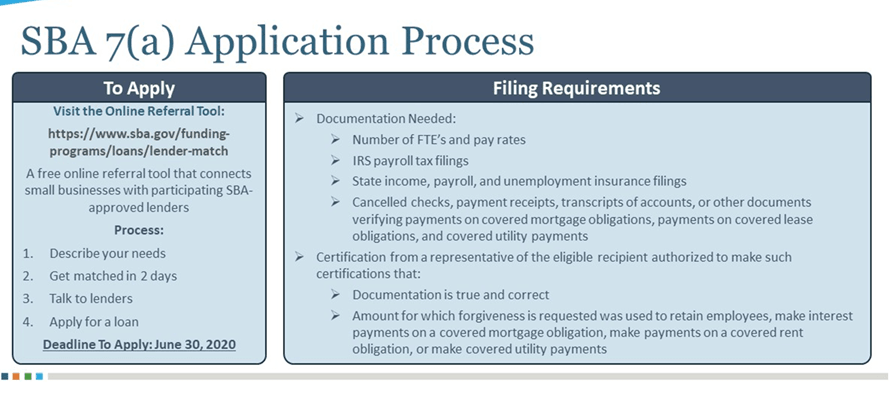

Provide an overview of how to apply to become a ppp lender and what steps to take as well as where to find more information 2. Please send a completed, signed, dated, and attested form 3506 to [email protected] and request approval as a ppp lender. Sba has streamlined the lending process for its lenders.

Someone who assists a lender with originating, disbursing, servicing, liquidating, or litigating sba loans; Before applying for an sba startup loan, evaluate the needs of your business. Starting april 3, small businesses and sole proprietors can begin applying for up to $10 million in the cares act’s ppp loans, treasury.

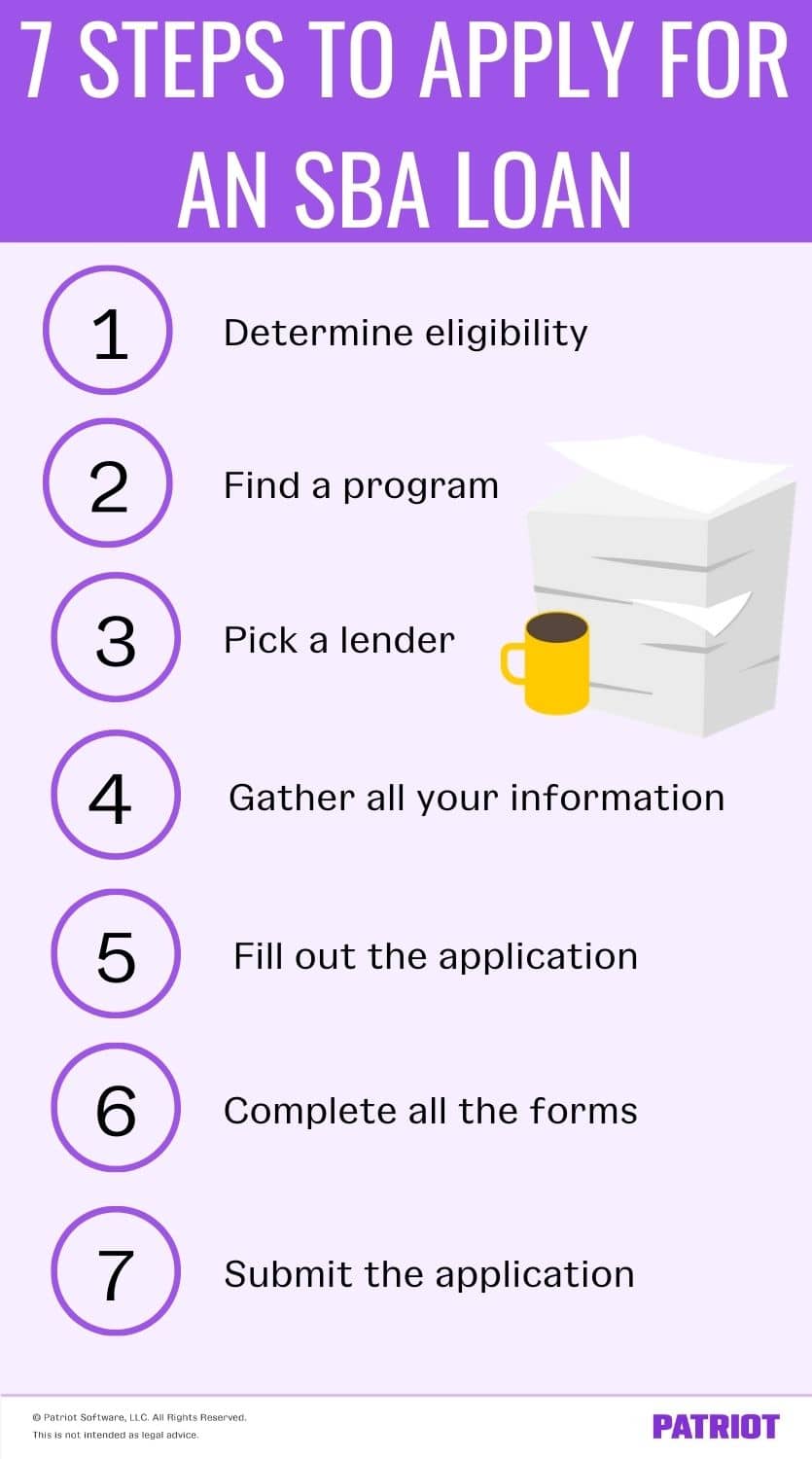

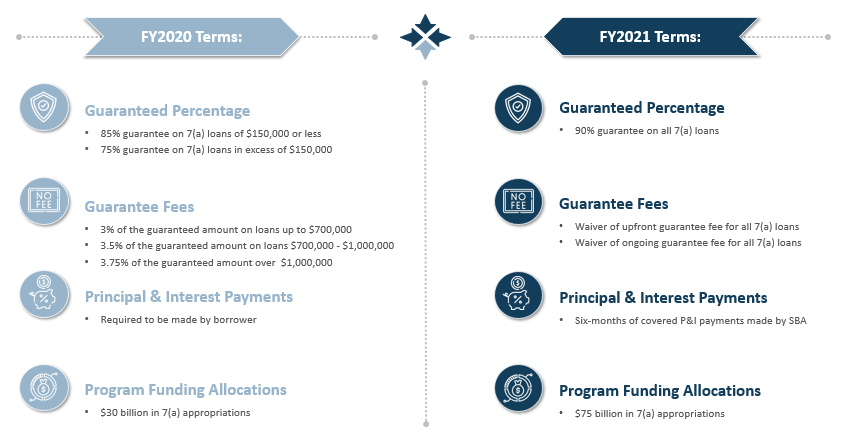

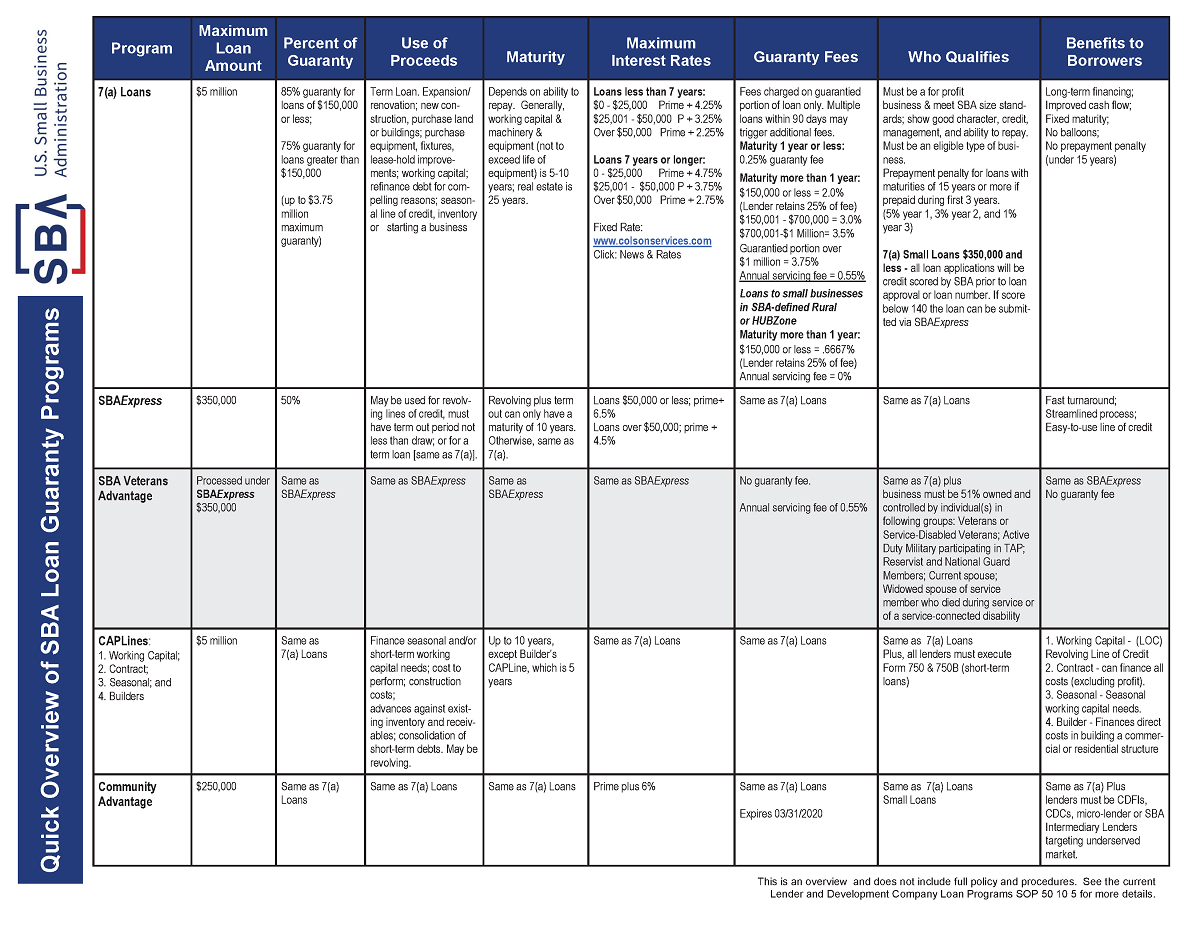

Review the major activities you regularly perform as a lender in the 7(a) program and the sba tools you use. What you need to know about the sba loan application process. 7(a) loans are flexible and can be used for a variety of business.

If you want to apply for sba loans, you'll need to meet certain minimal requirements. You want to become a sba lender but you don't know where to start? Those criteria vary depending on your business's financial profile as well as the type of sba loan.